Happy summer VoLo Earth community!

In recent years, Satya Nadella, the visionary CEO of Microsoft, has championed the idea that "every company is a software company." This concept has become a universal truth, reflecting the profound integration of digital technologies into the core operations of businesses across all sectors.

We see a similar transformation with the Energy Transition. Just as digital technologies and software evolved from niche applications to become fundamental pillars of businesses, the Energy Transition is set to permeate every industry.

The Energy Transition represents some of the largest total addressable markets (TAMs) in the global economy and encompasses the fastest-growing sectors at scale. Investment in the Energy Transition surged to nearly $1.8 trillion in 2023, marking an astonishing 90% increase since 2020, the year VoLo Earth was founded. This is on track to hit $2T this year. Forecasts suggest this investment could soar to between $5 trillion and $7 trillion by 2030. This explosive growth is projected to generate a market capitalization of $50 trillion to $100 trillion by 2040, capturing a substantial share of the global market cap.

Why Now?

The question of "Why now?" is a great place to start, and the answer is quite straightforward: energy consumers are always on the lookout for the best technology that offers the best service at the lowest cost. Traditionally, commodities have held this position. However, in recent years, manufactured technologies have emerged as the most cost-effective and highest quality options. This shift comes after decades of support, and subsidies, that have driven down costs and gradually built the necessary infrastructure. As highlighted in a recent report by the Rocky Mountain Institute, manufactured technologies often outperform commodities in terms of cost and speed, and that new solar and wind output will exceed electricity demand growth this year.

But for renewable energy to truly surpass commodities in terms of cost and feasibility on a large scale, the surrounding infrastructure needs to expand. This expansion is creating new multi-billion-dollar markets, including those for connectivity solutions, financial services, software ecosystems, and supply chain technologies.

And, it goes without saying, demand for Energy simply… can never go away.

The Investment Story

Investments in energy transition companies are where this story begins. These companies' projects generate revenue across the value chain and drive market cap expansion across sectors. (And just a friendly reminder: while this all sounds incredibly promising, please don’t base any actual investment decisions solely on this summary. Always do your own research and consult with a financial advisor.)

Capital Flows:

Infrastructure Capital: In 2023, $1.8 trillion was invested in energy infrastructure, including solar, wind, electric vehicles, and heat pumps. This represented a 17% increase from the previous year, and a 24% CAGR from 2020.

Revenue Generation: For every dollar invested in energy transition infrastructure, additional money (somewhere to the tune of $3-$5 per VoLo Earth sub-sector deep dives and operating experience) circulates up and down the value chain to produce, deliver, and operate that infrastructure. For example, installing a new solar farm pays solar panel producers, logistic companies, local contractors and support/maintenance, and utilities may upgrade power grids - further reverberating the former.

Profit Margins (EBITDA): As investment dollars move through the supply chain, companies capture profit. On average, as companies reach full scale, $0.30-$0.70 is captured as profit, with the rest covering costs like labor, rent, and utilities. This is based on VoLo Earth market analysis of mature and early stage companies within 17 submarkets of the energy transition across 13 value chain stages, and of course, still has room to vary.

Market Cap Creation: Applying EV/EBITDA multiples from comparable public markets, this $0.30-$0.70 in EBITDA translates to $10-$20 of market cap for every dollar invested.

Market Cap Implications

If $1 invested leads to $10-$20 in market cap, then for each $1 trillion of investment, we can expect $10-$20 trillion in market cap. If Energy Transition investments continue to grow at the current ~20% annual rate from $1.8 trillion, we will reach $5-$7 trillion by 2030, potentially creating $50-$100+ trillion in market cap by 2040.

The decoupling of emissions and economic growth is proving clear as the inverse becomes evident. Cleantech is already becoming an increasingly significant contributor to GDP growth globally - as the Energy Transition diffuses throughout all industries, this will become more true.

The VC Opportunity

For early-stage companies, this presents a substantial opportunity. For the sake of continuing the logic, let's say $10 trillion of the forecasted $50-$100 trillion is captured by all early-stage companies which emerge and mature over the next decade. The generally accepted rule of thumb in the Venture Capital industry is a targeted 3X return on average, which means for a $3 trillion return, the industry as a whole would need to invest about $1 trillion over a decade. This translates to an annual investment capacity of $100 billion, compared to the current $50 billion average annual deployment. Even if the ratio of value creation from new entrants to incumbents shifts, the order of magnitude and direction presents a compelling argument for the gap in annual VC deployment into the Energy Transition.

Addressing Biases and Opportunities

Many investors view the energy transition through one of two lenses: either as politically motivated and misaligned with their return goals, or as primarily an impact investment where returns are secondary to impact. However, the capital stack for the energy transition is maturing. In 2023, a record $57 billion in new capital was dedicated to climate infrastructure across the private equity industry. Yet, there's still a perception lag, with the energy transition often relegated to ESG budgets.

As the perception shifts and recognition of the energy transition's mainstream economic impact grows, those investing now are positioned to realize substantial returns. For venture capital, this landscape offers unparalleled opportunities to drive and benefit from this global transformation. Billion-dollar growth stage development strategies are already emerging in Europe, the Middle East, Southeast Asia, and the US, targeting this value chain segment. With close alignment of verticals, we can look to SwissRe’s value chain map as a high level framing of the core growth vectors within Buildings, Transport, and Industry:

Conclusion

The energy transition is more than just a trend; it's a profound opportunity that mirrors the digital revolution, poised to reshape every sector of the economy. The significant investments and market cap growth projections underscore the vast potential and critical need for continued capital inflows. For venture capital, this landscape offers unparalleled opportunities to drive and benefit from this global transformation. Those who understand the energy transition's transformative power and invest now are poised to reap substantial rewards, fostering a greener, more sustainable future.

VOLO EARTH COMMUNITY

Our June began in Berlin as co-hosts for Super Climate - sort of the Super Bowl for the climate tech world. VoLo Earth was excited to be accepted as one of the ~30 climate tech funds from across the world to co-host. We were able to collaborate with (and in some cases, meet in person) some of our favorite partners the global climate tech ecosystem. We left inspired by the momentum, and excited to help bring Super Climate to NYC in September (stay tuned!)

PORTFOLIO

Commercializing Solid-State Batteries

ION Storage System is awarded with a $20,000,000 grant from ARPA-E as one of four national projects focused on the commercialization of transformative energy technologies.

This is a massive achievement which will help ION execute with partner Saint-Gobain to commercialize solid-state-batteries across the globe for the first time.

In tandem, ION’s recent facility tour for the Maryland Department of Commerce, allowed state leaders to tour ION’s new 30,000-square-foot facility and gain a sneak peak at ION’s state-of-the-art solid-state battery production line, poised to scale up to 10MWh of capacity in the near future.

Reducing Concrete’s Cost and Carbon Footprint

AICrete announces the launch of their mobile App - as the article title acutely describes it: “Customers can now cut CO2 by up to 20% and double profit margins anytime, anywhere.”

Concrete is ubiquitous and the impact of reducing its CO2 footprint is massive; in AICrete’s first 40 projects alone, the tool has cut 36,852 tons of CO2 per year to date, while saving $3.07 per cubic yard.

The launch of the app brings these capabilities to customer’s fingertips, a milestone on AICrete’s mission to revolutionize global concrete operations.

Transforming Lithium-Ion Production

Congratulations to Virginia for a very well-deserved recognition.

The award is sponsored by ExxonMobile, and the award was created to “recognize pioneering leaders and innovators in the raw materials supply chain for excellence and sustainability.”

This is the first year of the award, making Virginia the inaugural winner.

Sustainable Metal Refining

Nth Cycle is selected by the World Economic Forum as a Technology Pioneer - a total of 100 companies globally. Megan O’Connor, CEO and Co-founder, is interviewed by the World Economic Forum on Radio Davos, to discuss how Nth Cycle creates metals from waste materials.

Megan highlights Nth Cycle’s use of electricity to produce chemicals, enabling a much more modular, scalable system, and partnerships spanning battery recyclers, steel, and mining companies.

As Vivek Salgaocar (WEF interviewer) nicely summarized the opportunity, “Suddenly a waste product becomes your raw material. What that means, then, is that you limit the amount of fresh extraction that you need. You limit the amount of geopolitical risk that you have because you’re no longer dependent on other countries.”

Autonomous Wildfire Detection and Suppression

The FAA Reauthorization Act, which became law last month, and sets aviation policies, included the following provision: “Not later than 18 months after the date of enactment of this Act, the Administrator…shall develop a plan for the use of unmanned aircraft systems by public entities in wildfire response efforts, including wildfire detection, mitigation, and suppression.”

This is the first time uncrewed wildfire suppression has been included in any federal legislation and represents a key moment for Rain.

AI-driven Battery Materials Discovery

Sepion announces deployment of its proprietary materials discovery platform, which utilizes AI in developing a non-flammable liquid electrolyte that can reduce the risk and severity of fires in EV batteries.

Sepion’s researchers subjected the discovered liquid electrolytes to flammability testing and demonstrated a self-extinguishing time (SET) that is 25 times better than commercial lithium-ion battery electrolytes. Check out the testing video!

The AI platform aided the discovery of this new liquid electrolyte, and is capable of 10M new formulations in just a week.

Smarter, Greener, and Healthier Buildings

BlocPower highlights the career path of Wes Booker, one of the Company’s most tenured Civilian Climate Corps graduates - who is now Assistant Construction Manager at BlocPower.

Over his two years in CCC, Wes was trained and ultimately supervised numerous trainees. “The work we do is to make everyone more safe and more comfortable in their homes, and make the environment a better place.”

Wes describes how BlocPower has created a platform for learning and career growth in which “the sky is the limit.” Go BlocPower :)

READING

@VoLoEarth: The NYT provides an interactive, visual data representation which tracks where in the world (any given day’s) 1) maximum temperature forecasts were extremely high as well as 2) where forecast temperatures are warmer than normal.

The site summarizes that “planet experienced its hottest-ever start to the year by a large margin. Through May 2024, every month since June 2023 has been the warmest on record for that month, and last year as a whole ranked as the warmest ever. Scientists say 2024 could become the warmest ever, edging out the withering record of the previous year.”

@VoLoEarth: In mid-June, 18”-20” of rain fell over Broward and Miami-Dade countries in a rainstorm (not a hurricane or tropical storm) which meteorologists call a one-in-200 years event. The storm has earned the name ‘Invest 90L’ and, despite being a bicentennial event, this level of storm has hit Florida four years in a row.

Under certain atmospheric and geographical conditions, elevated temperatures can trigger extreme rainfall through two mechanisms: increased evaporation and the enhanced moisture-holding capacity of warmer air. While this has historically been the case for South Florida summers, the past several years have seen a dramatic increase in severity.

Miami is listed as one of the 10 most vulnerable cities worldwide relative to the number of people at risk of coastal inundation. The proactive efforts of Miami-Dade and Broward county and the city’s ClimateReady Tech Hub offer a beacon of hope, with expansive initiatives demonstrating the potential to transform the region's unique combination of challenges into opportunities, potentially creating a blueprint for climate adaptation and urban innovation that could inspire cities globally. We’ll be keeping close eyes on you, Miami!

@VoLoEarth: A new bipartisan bill was was proposed by Andrea Salinas (D-OR) and Frank Lucas (R-OK) to support research, development, and testing of supercritical geothermal technologies. Supercritical geothermal is the operative word here - a category of enhanced geothermal systems which utilize deep drilling technologies to access dry rocks.

The bill seeks to unsure utilization of Frontier Observatory for Research in Geothermal Energy towards the testing of enhanced and closed-loop geothermal systems, as well as to create a Next-Generation Geothermal Centre of Excellence to focus on this new evolution of geothermal. If you’ve read our past newsletters, you have a sense of our level of excitement that closed-loop geothermal holds to provide baseload renewable power.

Frank Lucas is quoted, “Oklahoma is a national leader in geothermal energy so I’m very familiar with the tremendous value of this energy source […] Supercritical geothermal energy holds incredible potential for America’s clean energy future.”

This is an exciting and reassuring data point to reiterate our belief that many core aspects of the Energy Transition are, and must be, apolitical and bipartisan.

@VoLoEarth: In a similar vein to the above note on the apolitical opportunities induced by Energy Transition, this article summarizes a study by Climate Power which aggregated the total amount of jobs created by the IRA to surpass 300,000, and notes that additional researchers project the law will create a total of more than 5 million clean energy jobs over the next decade.

A study from E2, an organization united business leaders who advocate for environmental policies which protect the environment while building economic prosperity, is noted. This study found that of 210 publicly announced IRA-inducted projects across 39 states represent at least 74,181 new jobs alone, and that Republican-led congressional districts benefited the most from the bipartisan law in its first year.

E2’s executive director Bob Keefe states, “It’s like nothing we’ve seen in generations in this country. And by the way, it’s just the tip of the iceberg.”

@VoLoEarth: This extensive paper from Science Direct evaluates seven interacting feedback loops in offshore wind and electric vehicle acceleration as a case study for the role of positive tipping points in climate technology adoption. For anyone inclined to academic literature, there are some useful examples and frameworks in here for a read over a very tall cup of coffee.

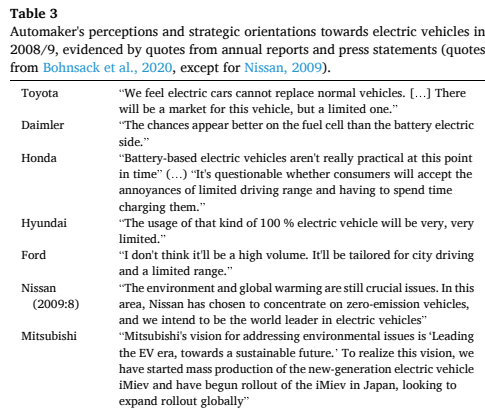

However, a quick and entertaining highlight on how quickly ‘consensus’ can change - check out the shift in automaker’s perceptions towards EVs between 2008/2009 and 2015-2017:

Pessimists sound smart, optimists make money