Happy Holidays VoLo Earth Community!

We hope everyone is looking forward to the holiday season and new year. As 2024 comes to a close, VoLo Earth reflects on a year of meaningful progress across our portfolio, team growth, and a year in which the energy transition moved towards the center stage of global discourse.

The energy transition is here. Most new power put on the grid is clean, driven by cost competitiveness. The benefits of renewables over incumbent systems (which waste ⅔ of the energy we generate) only continue to scale and steepen. Yet, much of the action - particularly in the most investable areas - is happening outside the headlines. It is within this nuance that VoLo Earth likes to operate.

The energy transition is not its own trend or sector, but rather, a horizontal force moving through the global economy. In many ways, the energy transition, perhaps only next to embodied AI, is the most important industrial transition in over a century. It is a complex system with complexity compounded by dependency on intricate supply chains. As such, clearly delineating ‘trends’ can be tricky. But, for you, our dear readers, we tried to narrow to the top four trends we tracked through 2024.

Energy Independence, Resiliency, and Security

Throughout 2024, we continued to see a convergence of security, resiliency, independence, and energy transition goals. Capital flows and industrial policy are shifting to address these as key (and related) priorities. Public and private sectors alike are placing an outsized emphasis on on-site, decentralized energy generation from a diversity of sources, resilience, reliability, and redundancy of that energy (i.e. via energy storage), and overall energy security.

Implications

Market and Policy Alignment: As we reduce our reliance on imported fossil fuels, we create a substantial new market for domestic energy production. This is often coupled with supportive policy that can reduce the investment risk and increase the ROI of domestic energy.

Infrastructure Modernization: As the broader need for infrastructure modernization becomes clear, we see infrastructure investments aligning with the energy transition - the downtime and operational risks associated with climate-induced disruptions change the equation. We see this in initiatives spanning microgrids, distributed energy resources, the electrification of mobility and Buildings, or advanced grid management.

New Capital Structures: In this vein, the energy transition capital stack is evolving with an outsized role of infrastructure-focused funds ($65B of $86B in climate dry powder) prioritizing long-term resilience and physical assets, while non-dilutive funding sources, such as defense contracts and government grants, support dual-use models that bridge public funding and private innovation.

Industrial Policy as a Catalyst: Initiatives like the IRA and CHIPS Act steer funding into infrastructure projects, bridging capital gaps and setting blueprints for energy transition policy.

Integrated Energy Storage: Technologies like Skyven or Blue Frontier exemplify integrated energy storage solutions, which can become critical contributions to the growing ecosystem of distributed energy resources (DERs). These innovations support broader Virtual Power Plant (VPP) strategies by optimizing energy efficiency and demand response.

Reflections

We will continue to see a very targeted approach in scalable technologies that have a measurable impact on energy independence and security. Energy storage technology will continue to play a crucial role, as will decentralized and diversified energy generation technologies. The biggest winner of all might be a platform approach that can automate and optimize this functionality for a government, a municipality, a corporate, or a consumer, all while improving the bottom line.

Relevant Portfolio Companies

De-globalization and Onshoring of Supply Chains

In 2024, geopolitical tensions and economic pressures brought supply chains front and center. The push for energy independence, raw material independence, and secure, domestic production of prime technologies accelerated, as fragmenting alliances and inflation in energy and materials markets exposed widespread fragility. A year of critical elections across the globe were united by this common thread; the race to build stable, regional supply chains and resilient manufacturing systems at home.

Implications

Geopolitical Shuffling: Fragmenting geopolitical alliances met with resource monopolies to expose material supply chain vulnerabilities (e.g., China's dominance over the battery supply chain, where we saw the battery supply chain used as a pawn amidst shifting political alliances). Concurrent failures in domestication efforts to date, like Northvolt’s bankruptcy, reiterate the urgency and difficulty of onshoring.

Critical Metals as Strategic Assets: Resources like lithium, cobalt, and magnesium evolved from one-time expenses to tradeable assets that are strategic for energy independence. This began to create opportunities to seed and scale domestic alternatives; for example, magnesium's dominance by China has amplified its strategic importance and inspired the Department of Defense to invest $20M in Magrathea - (the US’ first investment in magnesium manufacturing in over 40 years).

Strategic Onshoring and Stockpiling: Onshoring efforts (such as the historic launch of Nth Cycle’s Ohio facility) reflect a shift from reactive decoupling to proactive supply chain resilience through localized production. In Nth Cycle’s case, resilience via onshoring is also achieved through innovative utilization of existing domestic stock. Along this vein, domestic production may encourage nations to build strategic reserves of strategic metals.

Job Creation: Onshoring efforts tied to the IRA are driving outsized job creation in rural and conservative regions of the country. Investments in battery facilities and critical mineral recovery align economic revitalization with the energy transition, building bipartisan support and strengthening national resilience.

‘Real Economy’ Capital: The market has begun to take a long-term, ‘resilience and competition-focused’ view on manufacturing, materials, and metal innovation to rebuild supply chains - these themes are attracting a broadening range of asset classes. In addition to domestic battery companies such as ION, Sepion, or BattGenie, attention is also heating up for companies like Daanaa, whose chip-based power transaction technology slashes US manufacturer supply chain exposure with greatly condensed material and component needs.

Reflections

We will likely continue to see the emergence of new regional manufacturing hubs derived out of localized manufacturing growth that can create new opportunities in import/export, infrastructure, and new/unexpected alliances (politically and technologically). Workforce readiness will be both a blind spot and an emerging area of value creation. The ability to achieve and deliver on local supply chains while managing cost pressures and vulnerabilities will likely be a recipe for success.

Relevant Portfolio Companies

AI, Digitization, and Accelerating Energy

From revealing hidden resources below ground, optimizing systems above it (supply) or emerging as a prime, premium-paying customer (demand), AI is accelerating the energy transition from multiple angles as it weaves through the economy with similar fervor as the energy transition. 2024 gave the first signals of how these two major forces will interact. And while digitization is a recurring theme, it is now supercharged as it was forced to go from first date to meeting the parents in record time.

Implications:

Demand Premiums: Data centers, driven by AI workloads, are becoming significant energy consumers. Prioritizing speed and scale over cost, these companies are creating a premium market for fast, reliable energy solutions. These premiums can change the trajectory of emerging technology commercialization by allowing them to move more rapidly down the cost curve and into the broader market.

Discovery Innovation: AI-powered platforms are transforming subsurface imaging and resource modeling. Companies like KoBold Metals are finding new metal deposits faster while companies like VoLo Earth’s new (stealth) geological hydrogen discovery company applies similar methods to discover untapped energy sources.

Prosumer Engagement: Digitization enables decentralized energy systems, where consumers (prosumers) generate and trade their energy via blockchain or AI-driven platforms. Platforms facilitating peer-to-peer energy trading and microgrid management will attract significant capital.

Industrial Optimization: AI-powered tools (like AICrete’s AggSense) are transforming outdated industrial processes into precision-driven operations which can actively learn and which can be customized at scale. In the process, the application of new materials or processes can be discovered (or generated).

Reflections

With great risk comes great responsibility. We are clearly witnessing the most rapid rate of change in this trend, which also means uncertainty around policy and regulatory complexities. New potential infrastructure bottlenecks, or optimization opportunities, will be a double-edged sword as this trend goes into overdrive. Complacency around the expected energy demand growth associated with this trend will run rampant, so it will be important to consistently refine demand estimates and the associated solutions to basic levels so we can create scalable building blocks. Likely winners in this space innovate via discovery engines and AI-optimized digital twins based on localized conditions and challenges. This can be powerful as energy systems grow more distributed, integrated, or local.

Relevant Portfolio Companies

Interconnection, Baseload Power, and an Aging Grid

Addressing the grid’s shortfalls became a top priority as three terawatts of renewable energy - (six times the U.S.'s annual electricity consumption!) - sat idle in interconnection queues in 2024. The grid’s inability to accommodate new generation results from the collision of rapid renewable deployment with outdated infrastructure and new demand growth. As Google X described, “grid Planners have to anticipate what the grid might need to do every second of every day, years or even decades in advance. It’s heroes’ work and the job is getting harder each day.” Grid constraints both accelerated the need for and heightened the discussion around decentralized and behind-the-meter energy innovations, as well as the need for baseload power via geothermal, nuclear (fission and fusion), or other sources (storage-coupled generation, for example).

Implications

Stranded Assets: Baseload plants are becoming less competitive against renewables and storage, increasing the risk of stranded assets for fossil-fuel-heavy utilities. Investors may face write-downs on traditional baseload assets. This creates the space for energy generation innovations to focus on utilizing brownfield opportunities (stranded assets) in order to support cost and time to scale up. XGS’ approach to closed-loop geothermal captures this opportunity.

Scaling Storage and Hybrid Solutions: Innovations in battery components, such as Sepion’s lithium-ion separators, are filling domestic supply gaps and improving energy storage performance, enabling hybrid renewable systems (e.g., solar + battery) to provide "baseload equivalents" at lower costs and emissions, driving increased investment in these solutions.

Baseload Power Initiative: The intermittency of renewables has amplified the need for firm, dispatchable power sources and ushered venture dollars into sectors like geothermal energy and even geological hydrogen.

Decentralizing Energy: Localized solutions are redefining energy delivery and resilience, particularly in rural and high-demand contexts. From the nuclear-powered Three Mile Island to Skyven's first-ever industrial steam generating heat pumps systems to microgrids and community solar in rural regions demonstrate the leapfrogging potential of distributed energy systems.

Behind-the-Meter Pioneers: A diverse mix of players—Big Tech, defense agencies, industrial incumbents, real estate developers, and commercial users—are leading the charge in behind-the-meter adoption. Whether driven by energy security, economic pressures, or sustainability mandates, these stakeholders are accelerating decentralized, on-site energy innovation. New players are bringing with them new perspectives (and influence) ranging from policy to innovative PPAs.

Managing Developer Costs and Risks: Interconnection risks and uncertainty create project uncertainty and diminish project margins for developers. Investment in this trend will improve project economics and ROIs for developers and owner-operators.

Reflections

Energy participants, which is every human, company, or government on this planet, deserve stability, near fully-mitigated energy supply risk, and effective infrastructure. Any asset (from a power plant to a heat pump) that isn’t smart, ramp- and shift-able, with a 24-hour profile will become a stranded asset, which will create new opportunities as well. Beyond forecasting platforms, a focus of capital and value-creation must be on cost-effective implementation of new solutions. Perhaps step-change, supreme energy densities will offer new paths to managing the movement and delivery of energy, which will release some burden on traditional grids.

Relevant Portfolio Companies

Conclusion

As we’ve indicated since day one at VoLo Earth, it’s important to keep a secular approach to early-stage investing in the energy transition. Secular, in this case, meaning occurring over longer or indefinite periods (we do also try not to meddle any religion into our investment strategy, per the more familiar definition of the word). Being too reactive to near-term cycles and trends can lead to impulsive decision-making that is rarely without bias. As our content above shows, we monitor trends as we build intelligence and analytics engines, so we can be better informed as investors, board members, researchers, and colleagues. However, focusing on first-principles like winning economics, differentiated technology, rapid innovation and adoption, and outstanding people will always remain our key signal.

PORTFOLIO

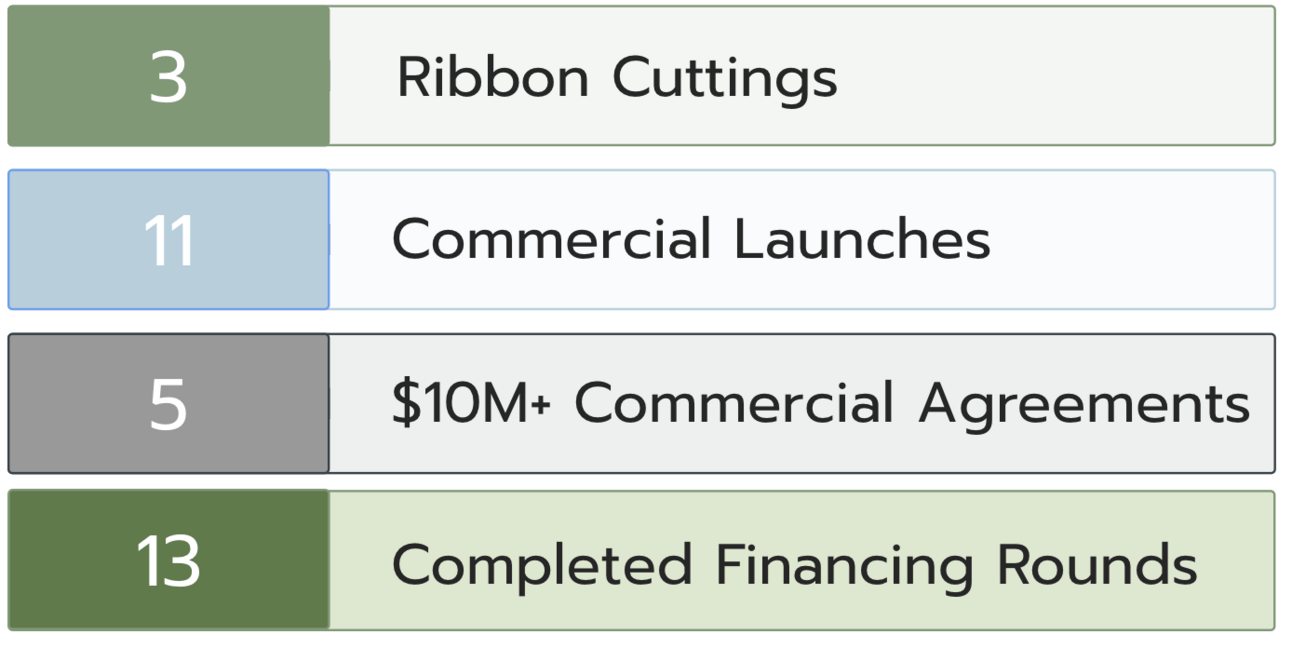

We are so proud of the groundbreaking strides made by our portfolio across the board this year, and so very excited to see what next year brings.

COMMUNITY

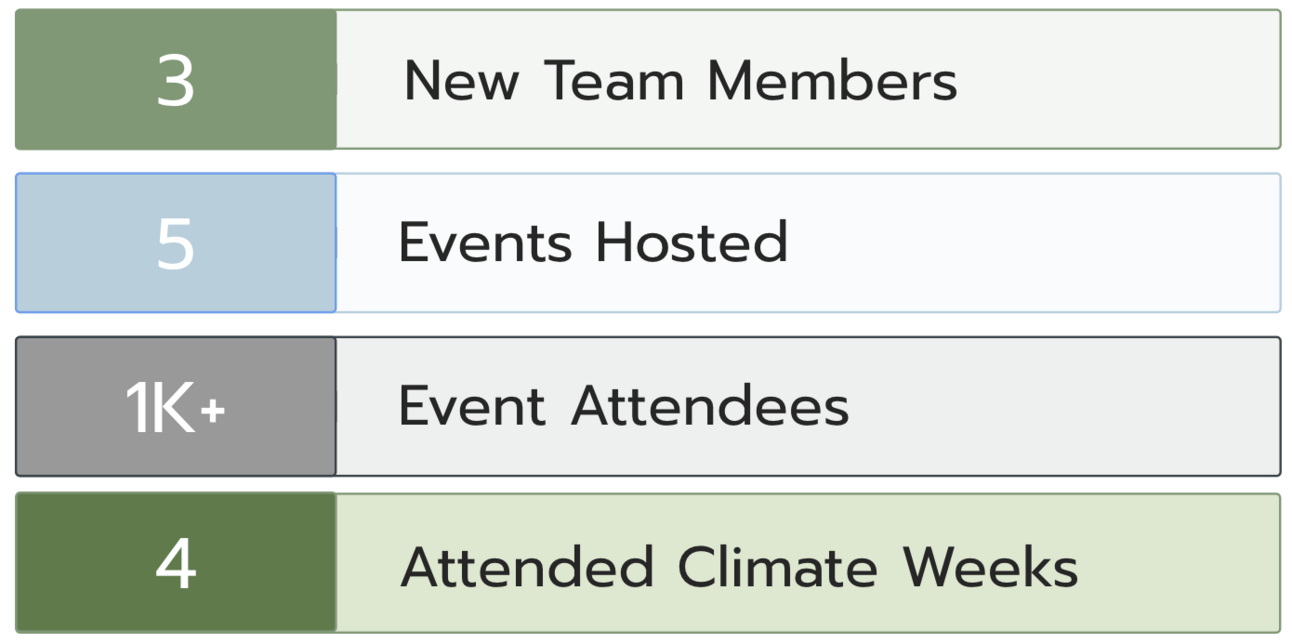

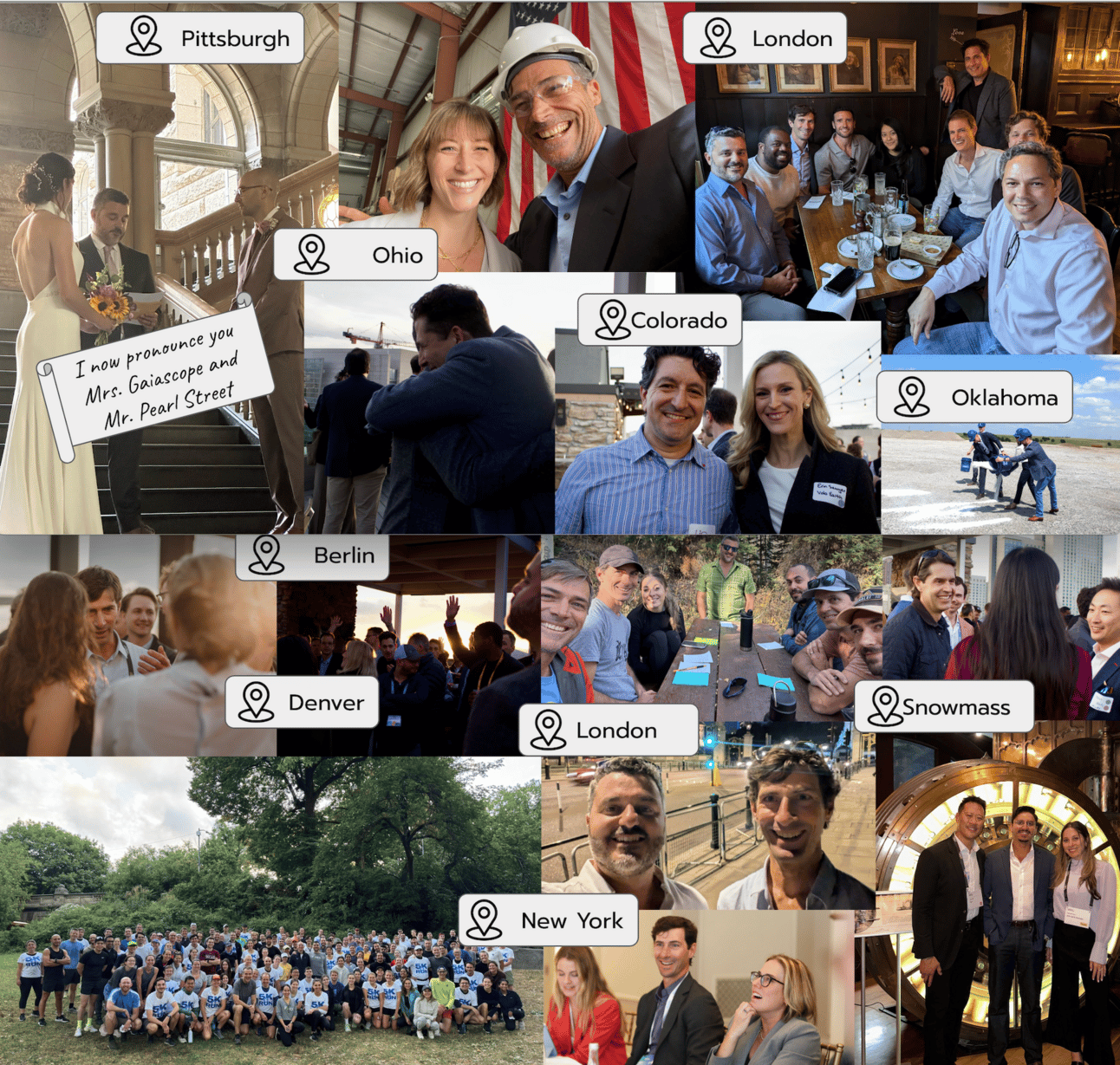

This year also saw the growth of our team and the opportunity to spend time and exchange ideas with many peers whose collaboration helps us, our portfolio, and the industry, constantly move forward.

Joe and Kareem were also able to share their perspectives through interviews by top-tier platforms like WSJ and Axios, speaking roles at marquee events hosted by Michael Bloomberg and Prince William, and contribution to thought leadership by industry leaders including GFANZ and ICM.

From witnessing groundbreaking facility launches, to bringing our founders together in London or CO or even holy matrimony… it was deeply rewarding to support the portfolio thrive in what can only be described as a ‘rainfall’ throughout 2024.

We are wrapping the year with gratitude and determination, and sincerely wishing you all a very happy new year .

And a quick reminder for anyone writing a new years wish list….